While you’re on the route towards successful entrepreneurship, obtaining a business loan becomes a survival entity in addition to a necessity.

Whether you’re gifted with sound business acumen to move your company forward or are struggling with an idea for a product that seems ideal for your target market – opting for a business loan at times seems necessary and wise.

While you might need it to kick start your venture, a struggling business might need to fund its transition towards new technological practices, a brand-new industry, or perhaps new research and developmental methodologies.

The process of acquiring a small business loan not only seems tedious but quite challenging and suppressing to those with meager cash flows. Apart from a variety of traditional legal documentation procedures, acquiring a business loan can be sorted out if you follow the guide below.

1. Assess different types of business loans

Before you seek a small business loan Florida, or wherever you are based, you must first assess the position of your company and the need for which you require the pressing amount in concern. For instance, do you need a business loan to finance your equipment or inventory or to kick-start your marketing campaign and hire more employees for your team?

Small business term loans, such as the one offered by bdo business loan providers, are designed for enterprises that are either expanding their business or have significant capital expenditures to foresee. With a monthly fixed or different interest rate, the entire principal of these term loans can be amortized within a period of 6 months to 3 years.

Another consideration is an unsecured business line of credit. Sometimes you may need extra funds for start-up expenses, marketing, expansion costs, etc. An unsecured business line of credit may be the perfect solution for your business.

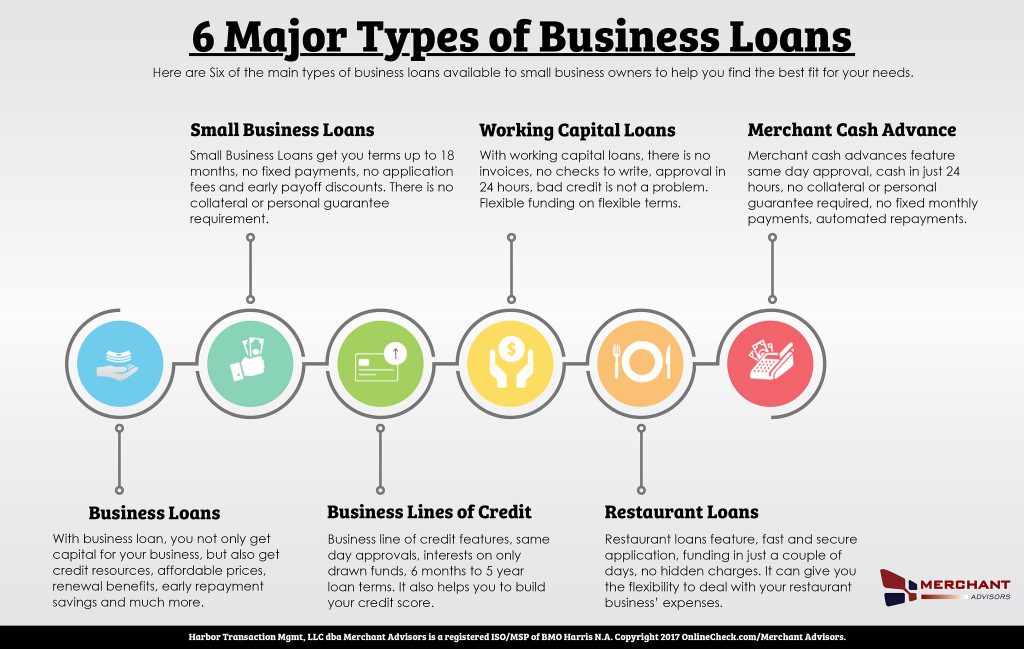

The following is a brief list of business loans that you need to be aware of before committing to one.

A small business line of credit

To set up a small business line of credit, you must consider three details.

- Annual fees to keep the account active

- Every small business line of credit has a cap set towards the availability of funds and is accessible at any time the business requires funding from the lender in concern.

- There is usually an interest payable by the end of each month, but the amortization of principal drawn down the small business line of credit is flexible and can be done within years.

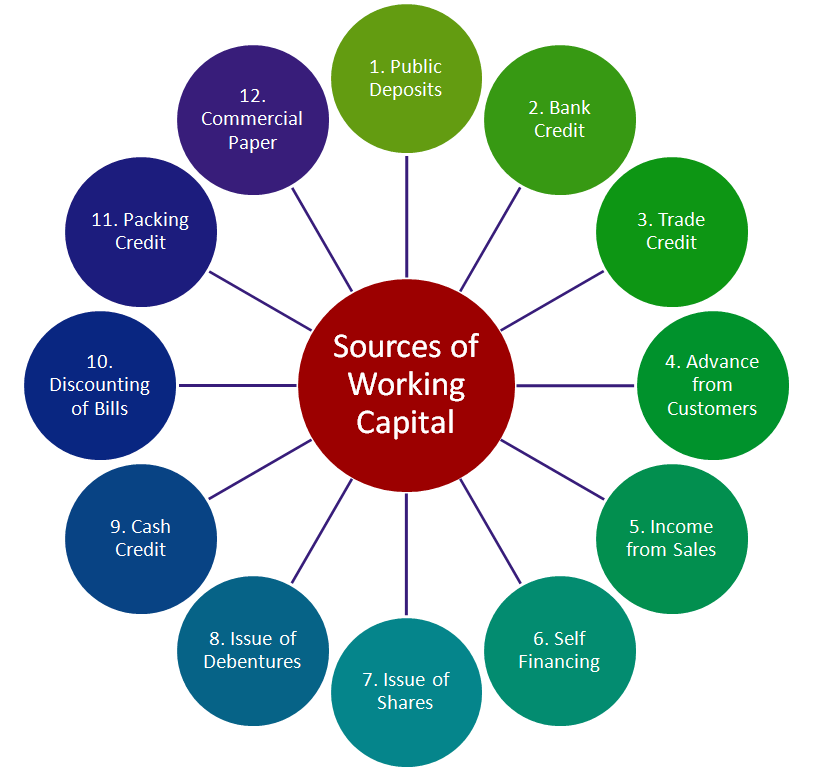

Working Capital Loans

Loan for Working Capital is chosen by businesses that are facing inadvertent discrepancies in handling daily working expenses or are at the hands of unusual seasonal fluctuations. These short-term loans span from a minimum of 30 days to a year to regularly facilitate businesses with poor cash flow management.

Working capital loans are ideal for small businesses or those that are merely starting with no credit history, as they can pledge with a personal guarantee in favor.

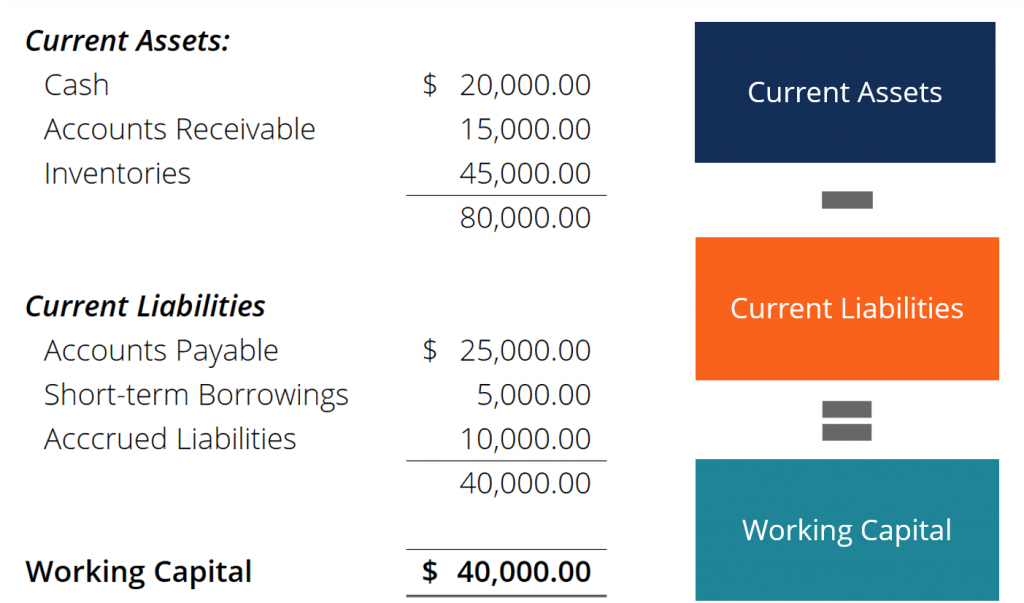

Above is an example of calculating your company’s working capital with the formula’s help.

Small Business Term Loans

Small business term loans are designed for enterprises that are either expanding their business or have significant capital expenditures to foresee. With a monthly fixed or different interest rate, the entire principal of these term loans can be amortized within a period of 6 months to 3 years.

Equipment Loans

These loans come in handy for small businesses facing trouble stocking up or upgrading their equipment or software because of their easy accessibility.

Equipment loans are secure and might require a down payment of 20% on the retailing instead of the original price of the equipment. You’d have to pay monthly interest on the loan and pay off the entire principal within the course of two to four years.

2. Seek Alternative Financing Routes

In addition to banks, there are plenty of financial alternatives that can act as far as better lenders than the traditional ones. For instance, direct online websites such as Fundera can help connect you with a magnitude of secure and trusted lenders.

Consider Swift Capital, a reputable online company known for its expansive working capital loans and small business cash advances. It can also be secured online.

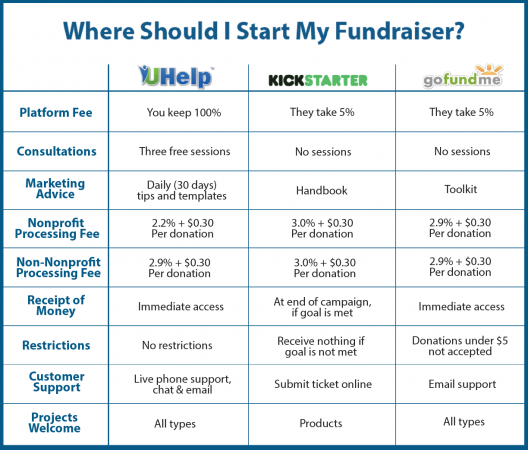

Crowdfunding websites such as IndieGogo and Kickstarter, to name a few, are also a few options for acquiring business loans under $10,000 through a varied group of independent online investors. Peer-to-peer lending websites such as Prosper and The Lending Club also help to connect the business loan seeker to the lender by acting as the intermediary or, in simpler terms, the middlemen for sealing deals with utmost security.

3. Assess Qualifications Before Choosing a Business Loan

Assess your Personal Credit History

Your personal credit history is highly essential for a lender to gauge your profile as a business owner. Your credit score denotes your reliability as an entrepreneur and the functionality of your small business.

Assess your credit score before you even decide to opt for a business loan. At times, most lenders prefer a stellar business credit score ranging from 700 – 800, while institutionalized lenders might settle if it is within 650 – 700 or 680+ at the very most.

Time in Business

Judging your time in business along with a stellar credit history, lenders are liable to offer unsecured and expansible working capital or short-term loans to individuals seeking business loans.

For instance, if your business is more than two years old and has a record of invoices, receivables, and receipts to vouch for the company’s reliability and operating hours, then you might be able to acquire unsecured working capital or credit lines from interested lenders.

Check your Cash Flow

Take notice of your company’s incoming receivables and invoices before you opt for a business loan whose interest or principal becomes hard to cover. For instance, if you can cover working capital loans and return the amount within the desired tenure, then opting for one to cover your expenses immediately might be an option to consider.

If you deal in 6-monthly tenures, then opt for a business loan that doesn’t compromise your payments. Always remember that the payments of your business loans can put a dent in your cash flow management, so assess the strength of your cash flows before you opt for alternative finances.

Many lenders will prefer checking your incoming and outgoing cash flows to decide whether repayment is an issue and whether they should consider you for a business loan or not.

Check your Revenue and Industry Risk

It’s necessary to steady your yearly revenue if monthly revenue seems unapproachable in the beginning so that you can apply for a business loan and promote the growth of your business. As a small business owner, it is necessary that you calculate your industry risk by taking the government’s ranking of SIC codes into consideration.

Look at what constitutes your company’s working capital.

4. Check your Financial Statements

If you’re planning on acquiring a small business loan ranging from $5,000 to $250,000, then your lender will proceed with the deal after checking your financial statements and accounting records. It is necessary that all your financial documents, inclusive of cash flow and income statements, balance sheets, and inventory bookkeeping records, are complete, up-to-date, and to the mark.

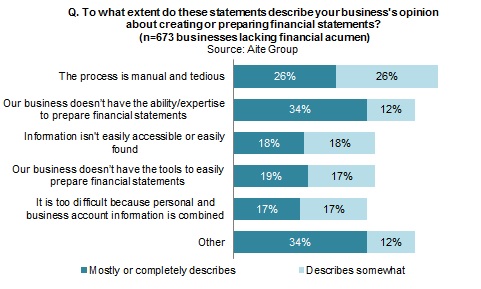

Below is a survey based on the preparation of financial statements.

If you’re not an expert at bookkeeping, consider hiring a certified public accountant (CPA) to assess your financial statements following your cash flow and other audits. With questions ranging from accounts receivable and payable to debt-to-equity ratio and your company’s gross margin, you must always be alert and honest.

Anticipate your cash flows and review your legal procedures before you ask your accountant to clue in the other details of your company’s financial statements for the past 2 to 3 years.

5. Check your Loan Application Form

Before opting for a business loan, make sure your business is registered in the directory and enlisted on online domains such as LinkedIn as a functioning entity. Each lender will check your business status before providing you with a term loan or working capital, which is why your pitch should be complete with your business model and other details.

For instance, assemble the legal documents such as the name of your business, its legal structure, insurance and liability policies, business credit reports, recent financial statements (at least those for the past 2-3 years), goodwill and good-standing certificates, foreign corporation filings amidst others required for the processing of the business loan.

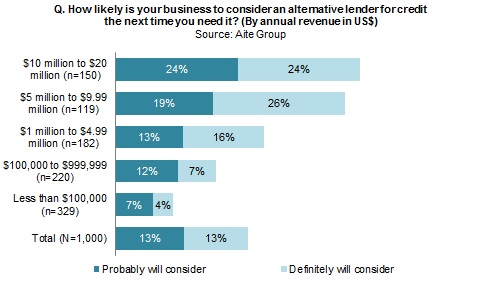

Here is the number of small businesses that prefer alternative lenders to banks.

Gather potential physical collateral that’s available and presentable for the processing of the loan, along with a guarantee as security interest so that the lender can proceed with his part of the deal as well.

Sometimes, some unorthodox lenders request acquiring the principal owner’s personal guarantee in exchange for the business loan. It will not only put your business at risk but your own commodities, such as property and other assets.

Get acquainted with the terminologies of the business loan type before seeking one. You can get help either from a legal practitioner or your company’s official attorney before processing the working capital for your business front.

Cover Image credits: Photo by David McBee from Pexels