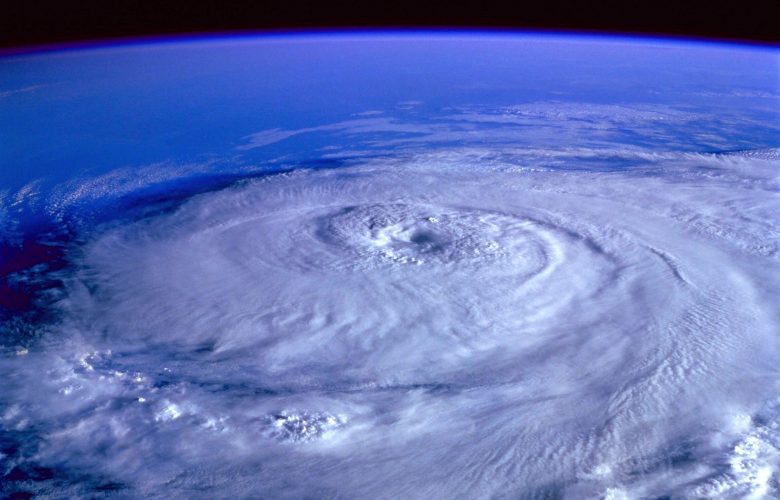

The devastation that hurricane flooding can cause is massive, both in terms of monetary and physical damage. Recovering from hurricane flood damage can be overwhelming.

It’s estimated that flooding is the costliest natural disaster in the United States. A Congressional Budget Office report estimates that annual economic losses from most types of damage caused by hurricane winds and storm-related flooding total $54 billion — $34 billion in losses to households, $9 billion to commercial businesses, and $12 billion to the public sector.

This year may be especially brutal. In May, NOAA’s Climate Prediction Center, a division of the National Weather Service, predicted an above-normal 2020 Atlantic hurricane season. The Atlantic hurricane season runs from June 1 through November 30.

Recovering from both the physical and financial damage of a hurricane may seem like an impossible task. There are several actions you can take to ease the recovery process.

As Soon As Possible, Document the Damage & File an Insurance Claim

It’s important to document the damage done to your property as soon as it’s safe. Create a detailed written record of all damage. You’ll want to take photos and videos – both wide and close-up images – of the interior and exterior damage done to your home or business. You should also keep copies of all receipts for repairs, medical bills, and hotel stays.

Once you’ve documented the damage, it’s time to file an insurance claim. Reread your homeowners’ insurance policy to see if it covers floods or hurricanes. Many homeowners’ policies don’t include coverage for either.

If you’re able to file a claim, it’s imperative that you file it as soon as you’ve documented the damage. Many insurance companies require claims to be filed within a reasonable amount of time. Receipts, photos and your written record will all be needed as evidence to file your insurance claim.

Before a disaster strikes it is always a good idea to evaluate the value of your home and contents. This will be very valuable information when you have to itemize items that were lost or damaged during the storm.

Next, Look for Disaster Relief Options

Disaster assistance is available to people in states the president has declared a major disaster area. You can check online to see if your area has been declared eligible for assistance. Disaster assistance can come in the form of loans, grants, tax deductions and deadline extensions, floodproofing, and counseling.

The Small Business Administration (SBA) also offers disaster assistance to businesses affected by a hurricane or natural disaster. The SBA provides low-interest disaster loans to help businesses recover from declared disasters.

Long-term recovery committees or groups may also form in your area after a disaster. These groups often work within the community to help individuals and families recover from a disaster.

Long Term, Take Steps to Recover Emotionally & Financially

The emotional and financial toll of experiencing a hurricane will take time to recover from.

Recovering from hurricane flood damage will take time but you will recover. The American Red Cross offers a number of steps to recover your financial well-being, including how to recover important documents.

This may also be a good time to speak with a licensed financial professional, like an accredited financial counselor, certified financial planner, or credit counselor. An accredited financial professional can help you sort out your current financial situation and better plan for the future.

It’s important to also take care of your emotional health after a disaster. The Red Cross’s website also has a number of resources available to help you recover emotionally.

Featured Photo by Pixabay from Pexels