Investing in commercial real estate can be extremely lucrative, but it’s a complex process that requires careful consideration. If you’re looking to branch out but have no experience, you’ll need expert advice every step of the way.

There are several factors to consider before making any decisions – what type of property you want to buy, how much risk you’re willing to take, how much money you need, and the list goes on. Each type of investment brings its challenges and its rewards, so knowing precisely what you want and how to get it is incredibly important.

Below, we cover just a few of the things to think about if you’re looking to make a commercial investment.

Know what you’re getting into.

First, you need to understand what it is you’re buying and what you’re going to do with it. Typical commercial buildings include hotels, restaurants, warehouses, office buildings, and apartment complexes. There are a lot of options. You may also be looking at buying a vacant lot of land and building onto it. Before you purchase anything, you need a solid understanding of what your plans are. Do you want to turn it into a business? Convert it for a different purpose? Rent it out?

If you’re new to buying and operating commercial real estate, it might be a good idea to find a mentor who can offer help and advice. Some things can only be learned by doing, and they will have the first-hand experience.

For information about purchasing residential property, visit socalhomebuyers.com.

Understand your budget.

Knowing what you can afford is so, so important. You shouldn’t even begin looking for a property until you have an excellent grasp of your budget and what you might expect to get for it. Not only that, but you also need to get to grips with what revenue you might expect to earn, as you’ll need to earn enough to cover your costs and make a profit. Take into account the expenses, including your mortgage, insurance, and taxes.

If you’re looking to lend money to make your investment, it’s a good idea to go with a lender based in California. It’s not a legal requirement, but state-based lenders will have a better handle on its different state laws and be able to provide more specific advice.

You might also want to seek advice from an accountant or tax advisor. They will be able to offer specific detail about whether your chosen property will meet your financial goals or not.

Book, a broker.

Your next important step is to find the perfect real estate broker. If you’re buying property in California, whether you live there or not, your broker must be licensed in that state. Carry out some initial research to create a shortlist of possibilities, and then narrow it down by digging into the specifics of each company. Make sure they’re experienced in selling the type of property you want to buy, and that they have the skills and ability to complete the transaction on your behalf. Once you’re happy you’ve chosen the right broker, you can determine the specifics of your purchase with a brokerage agreement.

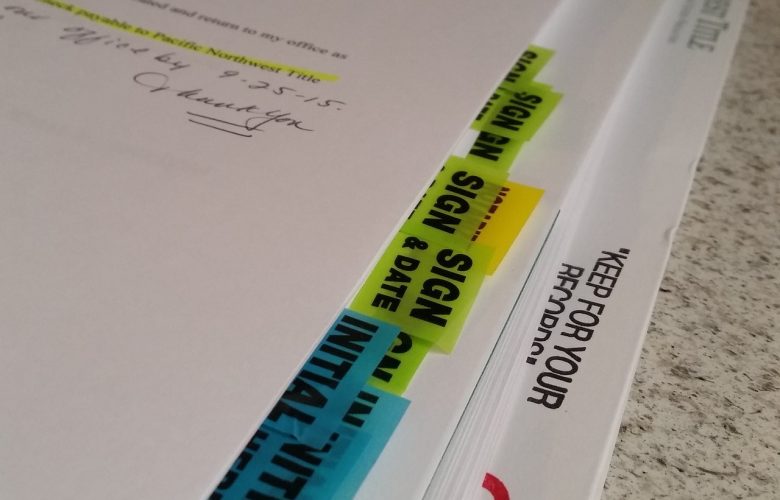

Brokerage agreements are documents drawn up between brokers and buyers that detail which party is responsible for the elements of your purchase transaction, and other details such as when the broker will be paid, how long their contract lasts, and so on.

Do your due diligence.

Due diligence is a thorough checking-out of the property you’re looking to buy. You need to make sure it’s a substantial investment and that you’re getting a good deal. Financial, physical, and legal are the three primary elements of due diligence. The physical part is pretty self-explanatory. It’s a property inspection. For the others, you may need expert help. Ask an accountant with relevant experience for the financial checks and an attorney (usually alongside an escrow company) for the legal elements.

Proper paperwork

As with any real estate transaction, you need to be sure you have copies of all paperwork that’s relevant to the property. The paperwork could include joint venture agreements, third party property agreements, leases, occupancy agreements, licenses, services contracts, or good standing certificates. Make sure everything is up to date and accurate.

You’ll also need copies of or to secure any permits you need, such as building permits, licenses, third party consents, and certificates of occupancy. Making sure you’re entirely covered is essential, as you may otherwise be in breach of state laws.

Cost it correctly.

The purchasing cost of the property is a significant consideration. You also need to consider the longer-term costs of running the property once you’ve taken possession. All properties will incur maintenance costs that must be factored in, plus any remodeling or renovation you need to do to make it fit for purpose. Depending on the nature of your business, you may also have licenses or certificates that need to be regularly renewed, and that may incur a cost.

Don’t overstretch.

Don’t try and do too much, too soon. Focus on one type of commercial property first and concentrate all your effort on making it a success. Then, once that first property is established, you can move on to other endeavors. Don’t forget that you’re not buying a property just for the sake of owning a ton of it. You’re buying it to make investments that will last in the long term. Overstretching yourself too far, too fast, could leave you with nothing at all.

You also need to think about how much time and effort you want to commit to your new property. For example, if you have the budget for a large apartment building, but don’t have the time or inclination for a large group of tenants, you might want to start with something smaller. That way, you can build a team of staff to manage the buildings for you, and then upgrade your property further down the line.